Travel and Tourism Forecasts

The National Travel and Tourism Office’s International Visitor Forecast

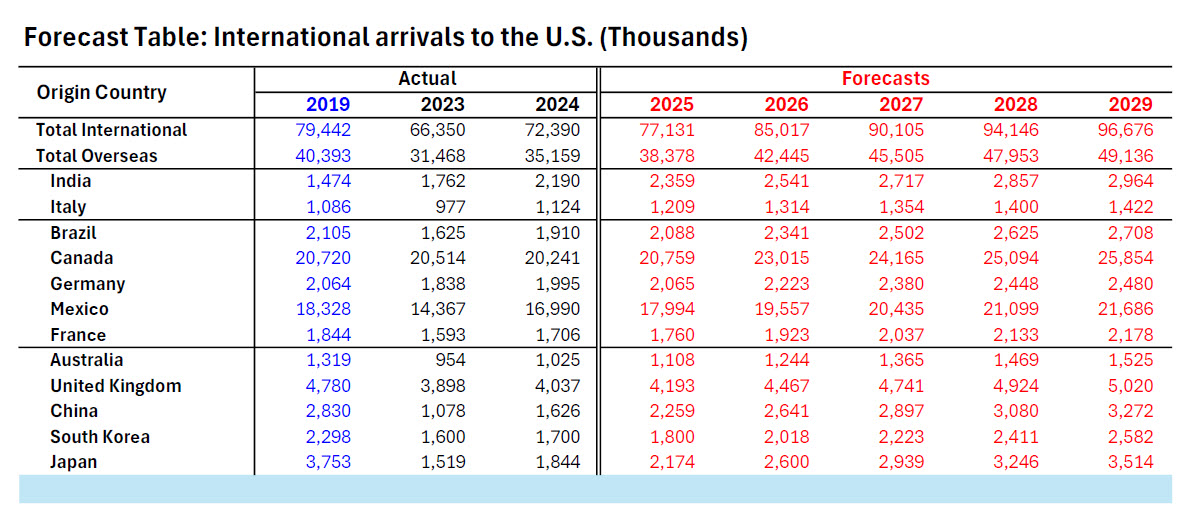

The National Travel and Tourism Office’s (NTTO) International Visitor Forecast estimates total international arrivals to the United States for years 2025-2029 from the top 12 U.S. source markets, as well as overseas (which excludes Canada and Mexico) and total international visitation from all countries.

Forecast:

Total international arrivals will continue to increase solidly over the next three years and will surpass pre-pandemic 2019 visitation in 2026. According to the forecast, total international arrivals will increase 6.5% to 77.1 million in 2025, rise 10.2% to 85 million in 2026, and grow 6% to 90.1 million in 2027.

To view the National Travel and Tourism Office’s International Visitor Forecast for 2025-2029 in its entirety, to include data tables and a full summary, please visit: